solid-crypto.site

Learn

Credit Cards You Can Use Instantly Online

Best instant approval credit cards by category ; Best for instant use. Canadian Tire Triangle Mastercard Annual fee: $0 ; Best for overall rewards. American. Instantly shop on the go by adding the virtual version of You can enter the credit card number manually to use it for online or in-person shopping, too. Access your credit line immediately with instant use credit card numbers. Discover more about instant approval credit cards and what providers offer them. After that, you can use your card online or in stores at your leisure. What happens if the application is denied? If a credit card application is denied, you'll. Find the best credit cards for you with Experian. Sign up for free and see relevant credit card offers matched to your credit score and credit profile. Spend safely and securely using your phone, just like a credit card - whether online, in-store or in-app. Set yourself spending caps and get instant balance. With your Virtual Card, you can shop online just as you would with a physical card. Virtual Card is issued when renewing your card or replacing. Can I use my credit card before it arrives? Some credit cards let you access your card details as soon as you're approved. These are often known as instant use. You can add your card to Apple Pay through the RBC Mobile app and enjoy quick online and in-store contactless purchasing using your Apple device. Best instant approval credit cards by category ; Best for instant use. Canadian Tire Triangle Mastercard Annual fee: $0 ; Best for overall rewards. American. Instantly shop on the go by adding the virtual version of You can enter the credit card number manually to use it for online or in-person shopping, too. Access your credit line immediately with instant use credit card numbers. Discover more about instant approval credit cards and what providers offer them. After that, you can use your card online or in stores at your leisure. What happens if the application is denied? If a credit card application is denied, you'll. Find the best credit cards for you with Experian. Sign up for free and see relevant credit card offers matched to your credit score and credit profile. Spend safely and securely using your phone, just like a credit card - whether online, in-store or in-app. Set yourself spending caps and get instant balance. With your Virtual Card, you can shop online just as you would with a physical card. Virtual Card is issued when renewing your card or replacing. Can I use my credit card before it arrives? Some credit cards let you access your card details as soon as you're approved. These are often known as instant use. You can add your card to Apple Pay through the RBC Mobile app and enjoy quick online and in-store contactless purchasing using your Apple device.

Online (or phone, if applicable) credit card application · Instant approval of that application · If eligible, you'll receive an instant card number and be able. Capital One® Walmart Rewards® Mastercard®: Eligible cardholders can use their Capital One credit card instantly by creating an account and verifying their. Plus, look out for exclusive offers delivered with your card that you can use instantly; Credit decisions are usually immediate but can take business days. Capital One SavorOne Student Cash Rewards Credit Card · Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores . No waiting! Apply for virtual credit card, complete Video KYC from home, get your virtual card details instantly upon approval and start using it. When you apply for a credit card, you may be instantly approved if the card issuer has enough information to make an automatic decision. If you're instantly. We offer virtual prepaid Visa and Mastercard bank cards that allow you to pay for goods and services anonymously online. We work worldwide so you can purchase. Which major card issuers offer instant card numbers? · American Express® · Bank of America® · Barclays · Capital One · Chase · Citibank · Navy Federal Credit Union. As with the previous card, you can use the First Access Visa Since MoneyMutual is an online lending marketplace, one short application can match you. You submit a credit card application online and receive an answer in seconds. If your application is approved you receive your card number, expiration date and. You will be immediately redirected to their e-commerce website and you simply need to use your CWB credit card as the payment method at checkout. Partners with. What can I use my virtual card for? You can use your virtual card anywhere Mastercard is accepted online, or when you add it to your Google, Apple, or Samsung. Virtual Credit Card by Standard Chartered Bank Welcome to the electronic version of your credit card – secure, easy to use, and instant. Now you may initiate. Compare credit cards from our partners, view offers and apply online for the card that is the best fit for you. Advertiser Disclosure: Many of the card. You can change it once each calendar month, or make no change and it stays the same. 0% † Intro APR for your first 15 billing cycles for purchases, and for any. Instant use credit cards are accounts you can use immediately after you are approved. You are provided with a virtual credit card number or another option, such. Visa Credit Cards · Amazon · Applied Bank · BILL Spend & Expense · Capital Bank · Capital One · Celtic Bank · Chase · Chime. The Huntington Cashback Credit Card lets you earn % unlimited cash back on every purchase in store, online, and everywhere in between. For example, the PREMIER Bankcard Grey Credit Card accepts applicants with poor credit and states online that you can “receive a response in 60 seconds.” But. Can you use a credit card the same day you get it? With instant-use credit cards, you can use the card upon approval, which could happen almost instantly. For.

What Is A Share Option

:max_bytes(150000):strip_icc()/dotdash_Final_Stock_Option_Definition_Aug_2020-01-ba7005182cda419a883d6b140a04ef09.jpg)

A share option agreement is a contract between a company and option holder where the latter loans shares to collect revenue on stock that would otherwise. Tax advantages on employee share schemes including Share Incentive Plans, Save As You Earn, Company Share Option Plans and Enterprise Management Incentives. The meaning of SHARE OPTION is a right that is given by a company to an employee that lets the employee purchase stock in the company usually for a price. What are call option plans? An options plan is one type of ESOP scheme and is a method of granting equity (or ownership) to an employee over a period of time. What are Options? An option is the right (but not the obligation) to buy a share(s) before a specified future date (vesting date) at. A share option agreement is an agreement between the holder of shares and a third party giving one party the right (but not the obligation) to purchase or sell. Share options are a way of saying to staff, “When the company gets bigger, in a few years time, you can have the option of buying some shares at a price we. EMPLOYEE SHARE OPTION meaning: a special agreement that gives an employee the right to buy company shares for a particular price. Learn more. An employee stock option (ESO) is a type of equity compensation granted by companies to their employees and executives. A share option agreement is a contract between a company and option holder where the latter loans shares to collect revenue on stock that would otherwise. Tax advantages on employee share schemes including Share Incentive Plans, Save As You Earn, Company Share Option Plans and Enterprise Management Incentives. The meaning of SHARE OPTION is a right that is given by a company to an employee that lets the employee purchase stock in the company usually for a price. What are call option plans? An options plan is one type of ESOP scheme and is a method of granting equity (or ownership) to an employee over a period of time. What are Options? An option is the right (but not the obligation) to buy a share(s) before a specified future date (vesting date) at. A share option agreement is an agreement between the holder of shares and a third party giving one party the right (but not the obligation) to purchase or sell. Share options are a way of saying to staff, “When the company gets bigger, in a few years time, you can have the option of buying some shares at a price we. EMPLOYEE SHARE OPTION meaning: a special agreement that gives an employee the right to buy company shares for a particular price. Learn more. An employee stock option (ESO) is a type of equity compensation granted by companies to their employees and executives.

Share Option Reserve means the total reserves based on the valuation of share options. Sample 1 Based on 1 documents 1 Save Copy. This one-stop guide to share options and employee share option plans (ESOPs) will help you answer these questions, and many more besides. The price at which the option can be exercised is fixed at the date the option is granted. Employee share options are often granted by deed. For information on. Share Option. The Corporation hereby grants to the Optionee, subject to the terms and conditions hereinafter set out, an irrevocable option to purchase at. A share option is the right to buy a certain number of shares at a fixed price, some period of time in the future, within a company. The purpose of this Share Option Scheme is: To attract and retain skilled and experienced personnel for the important positions. The price at which the option can be exercised is fixed at the date the option is granted. Employee share options are often granted by deed. For information on. These plans provide employees and directors with the opportunity to purchase company shares at a predetermined price within a specified timeframe. An employee share option plan (ESOP) is a scheme designed to offer employees the opportunity to purchase shares in their company, often at a discounted price. A share option agreement gives a person the option to purchase a company's shares at a future date at a price that is typically below the fair market value. A share option is an agreement between the holder of shares and a third party. An option gives one party the right (but not an obligation) to purchase. A share option is where the employee is granted a right to acquire shares at the end of an agreed option period for a price at the date the option is granted. A scheme giving employees an option to buy shares in the company for which they work at a. Click for English pronunciations, examples sentences, video. A trade in the listed options market constitutes a contract between the buyer and seller, and any exchange of shares due to the exercise of an option is from. Options generally do not accrue to the individual immediately, but over a specified period, usually four years. Under such an arrangement, the employee accrues. A company share option plan is designed so that employees can take a long-term stake in the company that they work for. From the. Ordinary shares are real shares in the business (rather than an option to buy at a later date) and can be given to anyone. · Growth shares. Share Option. The Corporation hereby grants to the Optionee, subject to the terms and conditions hereinafter set out, an irrevocable option to purchase at. A share option is a contract pursuant to which one party has the right (but not the obligation) to acquire shares from another person or to sell shares to. An Employee Share Option Plan (ESOP) is a strategic tool to foster employee engagement and drive business growth.

Ftx Us Leverage Trading

Crypto-derivatives exchange, FTX, has launched volatility tokens and oil futures on its platform in the past 48 hours. Blockchain. 5, items. Companies and startups in this collection leverage blockchain technology for crypto trading, decentralized finance (DeFi), NFTs, and. They accept US traders without VPN or KYC thanks to the MSB license they obtained in the USA. x leverage, + altcoins and lower fees than. FTX offers a wide variety of indices and leveraged tokens that can be traded on the futures or options market. Bybit: Bybit is a trading platform that allows. Cryptocurrency exchange solid-crypto.site has added a board of directors as the company vies for regulatory approval to extend leverage to derivatives traders. FTX is a centralized cryptocurrency derivatives exchange based in the Bahamas that offers a wide range of sophisticated trading instruments such as Leverage. FTX was a leading cryptocurrency exchange that went bankrupt in November amid allegations that its owners had embezzled and misused customer funds. FTX US crypto price in their account. Customers can trade on the FTX US spot market with up to 10x leverage. FTX US also supports options and futures trading. FTX US margin trading allows investors to trade assets using borrowed funds, amplifying both potential gains and potential losses. On the FTX US platform. Crypto-derivatives exchange, FTX, has launched volatility tokens and oil futures on its platform in the past 48 hours. Blockchain. 5, items. Companies and startups in this collection leverage blockchain technology for crypto trading, decentralized finance (DeFi), NFTs, and. They accept US traders without VPN or KYC thanks to the MSB license they obtained in the USA. x leverage, + altcoins and lower fees than. FTX offers a wide variety of indices and leveraged tokens that can be traded on the futures or options market. Bybit: Bybit is a trading platform that allows. Cryptocurrency exchange solid-crypto.site has added a board of directors as the company vies for regulatory approval to extend leverage to derivatives traders. FTX is a centralized cryptocurrency derivatives exchange based in the Bahamas that offers a wide range of sophisticated trading instruments such as Leverage. FTX was a leading cryptocurrency exchange that went bankrupt in November amid allegations that its owners had embezzled and misused customer funds. FTX US crypto price in their account. Customers can trade on the FTX US spot market with up to 10x leverage. FTX US also supports options and futures trading. FTX US margin trading allows investors to trade assets using borrowed funds, amplifying both potential gains and potential losses. On the FTX US platform.

So if you're wondering how to use leverage bitcoin trading in the USA, Kraken is the place to go. On Binance Futures, traders can trade with. A surprisingly large number of us come from a trading background. And as traders, we think a lot about capital efficiency and liquidity. market trading on solid-crypto.site and derivatives trading If accepted, FTX's application would alter the role of U.S. registered FCMs proposing leverage without. FTX Exchange was a leading centralized cryptocurrency exchange specializing in spot markets, derivatives, options, volatility, and leveraged products. Learn how you can utilize FTX Token margin trading for FTT leverage with Kraken — the secure cryptocurrency exchange. So what exactly is FTX Token margin trading? FTX Token margin trading lets you buy and sell FTT using funds that could exceed the balance of your account. These leveraged tokens allow traders to put leveraged positions without the need to trade on margin. FTT is also used to reduce trading fees and to secure. FTX US crypto price in their account. Customers can trade on the FTX US spot market with up to 10x leverage. FTX US also supports options and futures trading. FTX Token's price today is US$0, with a hour trading volume of $N/A. FTT is +% in the last 24 hours. What is FTX Token? FTT is the native token for. an FTX affiliate (i.e., “LedgerX” or “FTX U.S. Derivatives”) filed a proposal with the Commodity Futures Trading Commission that had the potential to. Describe the problem: I have access to leverage on solid-crypto.site, I am trying to do taxes on my trading but literally every time I plug my ftx stats into any tax. solid-crypto.site claims to be “built by traders for traders” and offers instant Is It Possible To Use Leverage or Margin Trading on FTX US? Margin trading. Leading cryptocurrency exchanges FTX and FTX US have announced an integration with world class automated trading bot Cryptohopper, resulting in significant. Figure 1: Schematic depiction of the leverage mechanism used by FTX and Alameda Research. Binance sees 30% surge in trading activity on ftx implosion. FTX Trading Ltd.,” U.S. Bankruptcy Court for the District of Delaware, Dec. 28, , and “Sam Bankman-Fried's secret 'backdoor' discovered, FTX lawyer says,”. Setting Up a Margin Trading Account on FTX US · Borrowing Funds and Managing Collateral · Strategies for Effective Leverage Usage and Risk Management. exchange to the trading firm, as well as excessive leverage provided by non-bank sources and a weak liquidity risk management framework. Those exposed to. margin trading which incurs higher fees than futures contracts. Another exchange that currently allows spot margin trading in the US is Kraken, however leverage. Why do most forex traders use leverage?Most leveraged traders are engaged in foreign currency trading, mainly because most forex strategies use small. US dollars or other crytocurrencies for trading purposes or purchases. leverage and insider trading going on between FTX and Alameda. On November 6.

Registered Investment Advisor Act

A passing score on a competency examination for each individual acting as an investment adviser representative or on behalf of a state-registered investment. Two comm registration exemptions for investment advisers are: private fund advisor exemption and venture capital fund advisor exemption. Advisers to investment companies registered under the Investment Company Act of (the. “Investment Company Act”) must register with the SEC. The. Who must register as an investment adviser? The Advisers Act presently requires that, absent an exemption from registration, investment advisers using means of. (29) The term "private fund" means an issuer that would be an investment company, as defined in section 3 of the Investment Company Act of (15 U.S.C. 80a–. Rule A-1 under the Advisers Act requires investment advisers to adopt codes of ethics covering personal trading and fiduciary duty. Unless exempt from registration, the investment manager/adviser to a “private fund” in the United States is required to register as an “Investment Adviser” (“. The SEC regulates investment advisers who manage $ million or more in client assets, while state securities regulators have jurisdiction over advisers who. any investment adviser registered under the Investment Adviser[s] Act of [15 U.S.C. 80b–1 et seq.] that provides investment advice to the family office. A passing score on a competency examination for each individual acting as an investment adviser representative or on behalf of a state-registered investment. Two comm registration exemptions for investment advisers are: private fund advisor exemption and venture capital fund advisor exemption. Advisers to investment companies registered under the Investment Company Act of (the. “Investment Company Act”) must register with the SEC. The. Who must register as an investment adviser? The Advisers Act presently requires that, absent an exemption from registration, investment advisers using means of. (29) The term "private fund" means an issuer that would be an investment company, as defined in section 3 of the Investment Company Act of (15 U.S.C. 80a–. Rule A-1 under the Advisers Act requires investment advisers to adopt codes of ethics covering personal trading and fiduciary duty. Unless exempt from registration, the investment manager/adviser to a “private fund” in the United States is required to register as an “Investment Adviser” (“. The SEC regulates investment advisers who manage $ million or more in client assets, while state securities regulators have jurisdiction over advisers who. any investment adviser registered under the Investment Adviser[s] Act of [15 U.S.C. 80b–1 et seq.] that provides investment advice to the family office.

Any natural person acting as a solicitor that is not otherwise registered as an investment adviser representative. The single class of registration. The SEC has a regulatory requirement to approve or deny investment advisor applicants within 45 days of the firm's initial filing. Most state securities. (1) A person may serve a non-resident investment adviser, non-resident general partner, or non-resident managing agent by furnishing the Commission with one. (i). The Advisers Act requires the registration of fund advisers and requires certain disclosures regarding the adviser's background and business practices. The Commission, as it deems necessary or appropriate in the public interest or for the protection of investors, shall adopt rules or regulations to require. Advisers Act Rule requires investment advisers to make an initial delivery of a current Brochure before or at the time the investment adviser enters into. The Gramm-Leach-Bliley Act of (GBLA) imposes restrictions and obligations on financial institutions — including registered investment advisors. a statement as to whether the principal business of such investment adviser consists or is to consist of acting as investment adviser and a statement as to. Investment advisers and investment adviser representatives must renew their registration/license annually. In many states, the term is from January 1 to. Rule A-1 of the Advisers Act requires all "Access Persons" of an investment adviser registered with the SEC to report, and the investment adviser to review. § , Application for investment adviser registration. ; § , Withdrawal from investment adviser registration. ; § , Hardship exemptions. While there are some exceptions, in general, investment advisors with $ million or greater in regulatory assets under management (AUM) must register with. Who Must Register? Every person who, for compensation, renders investment advice or provides financial planning services that includes investment advice in. Investment advisers may be primarily regulated by the U.S. Securities and Exchange Commission (SEC) or by one or more state securities authorities. The term “investment adviser” includes financial planners and firms or individuals that advertise, hold themselves out as or otherwise act as investment. Section -- Findings Section -- Definitions Section -- Registration of Investment Advisers Section A -- State and Federal Responsibilities. IA40 is a federal law, applicable only to investment advisers that register directly with the SEC. In the mids, the National Securities Market Improvement. Investment Adviser Act practitioners need to be familiar with certain fundamental requirements that shape the advisory relationship and to which advisers are. (a) Every investment adviser registered or required to be registered under section of the Act (15 U.S.C. 80b-3) shall make and keep true, accurate and. Investment advisers who register with the Securities and Exchange Commission ("SEC") under the Investment Advisers Act of , as amended ("Advisers Act").

U Of M Online Classes

Massive Open Online Courses (MOOCs) from University of Michigan faculty and instructional teams. week self-paced learning experiences. Join learners from around the globe in accessing the University of Michigan's courses on Coursera. Immerse yourself in a learning experience designed to. Michigan Online is the destination for online learning experiences created at the University of Michigan including courses, degrees, series, Teach-Outs. Most UIS online courses are asynchronous, which means you can ignore the clock. Your classes will be on a schedule, but there are no required "live" classes to. As a campus of the University of Minnesota system, the University of Minnesota Crookston online programs offer you access to world-class teaching and learning. Earn a University of Minnesota online bachelor's degree from the convenience of your own home. Our online undergraduate degrees are equivalent to. A fully online course conducts all learning activity in an online environment, with no face-to-face (F2F) contact. Students and the instructor login and. The University of Minnesota offers many online courses in a variety of degree programs. Online offerings are available from Crookston, Duluth, Morris, Rochester. Find every English-taught Online degree from University of Manitoba, organised by subjects and best info to help you select the right degree. Massive Open Online Courses (MOOCs) from University of Michigan faculty and instructional teams. week self-paced learning experiences. Join learners from around the globe in accessing the University of Michigan's courses on Coursera. Immerse yourself in a learning experience designed to. Michigan Online is the destination for online learning experiences created at the University of Michigan including courses, degrees, series, Teach-Outs. Most UIS online courses are asynchronous, which means you can ignore the clock. Your classes will be on a schedule, but there are no required "live" classes to. As a campus of the University of Minnesota system, the University of Minnesota Crookston online programs offer you access to world-class teaching and learning. Earn a University of Minnesota online bachelor's degree from the convenience of your own home. Our online undergraduate degrees are equivalent to. A fully online course conducts all learning activity in an online environment, with no face-to-face (F2F) contact. Students and the instructor login and. The University of Minnesota offers many online courses in a variety of degree programs. Online offerings are available from Crookston, Duluth, Morris, Rochester. Find every English-taught Online degree from University of Manitoba, organised by subjects and best info to help you select the right degree.

University of Michigan. **University of Michigan subreddit** Post anything related to the University of Michigan. Be it class, sports, clubs. University of Michigan Courses · With certificate (). Free course (). With free certificate (8). University course only () · Level. Beginner (). Join learners from around the globe in accessing the University of Michigan's courses on Coursera. Immerse yourself in a learning experience designed to. Complete the following steps to see the online course options available to U of M Twin Cities students. For INSTRUCTION MODE, select Completely Online. This guide will provide you with strategies and resources for successful course completion in a remote /online learning environment. Get information on Online Bachelor's program at University of Michigan--Flint at US News. Find out what Bachelor's are offered and information on admissions. Programs and courses · Courses · Business finance and management · Process and technology management · Public sector and municipal administration · Intensive program. Online Courses · Login to your course via Canvas. · Check the catalog for academic policies and regulations regarding online class attendance. · Check your. The BBA degree with a major in Management Information Systems (MIS) at the University of Memphis is offered fully online by the Fogelman College of Business &. UMOnline · University of Montana online programs provide quality and convenience for students and faculty · Current and Prospective Students · Faculty and Staff. To view a list of available Distance and Online Education courses offered at the University of Manitoba, please follow the below steps: 1) Go to aurora. I've only taken one online course at the U of M (PHIL ), but I really enjoyed it. Compared to my friends who took the course in person, the. Online Degree Programs · Artificial Intelligence (MS) · Automotive and Mobility Systems Engineering (MSE) · Business Administration (MBA) · Computer Engineering. With the University of Michigan online courses available on edX and Coursera, you won't only save a huge amount of money (many of the courses are free, with. Online Programs Rankings · #8. in Best Online Master's in Engineering Programs (tie) · #5. in Best Online Master's in Civil Engineering Programs (tie) · #6. in. If I'm all online, I want to get out of my **University of Michigan subreddit** Post anything related to the University of Michigan. List of all free University of Michigan online courses, classes and Mooc courses from University of Michigan. Most of these Mooc courses teach by. K Online Learning, Advanced Placement (AP), Credit Recovery, Cybersecurity, Dual Enrollment, EdReady, Math and English, Summer School, Middle School. Explore our online programs and find a degree that is right for you. Embrace flexible learning at St. Mary's of Minnesota. MSU is one of the top universities in the world and offers online degree & certificate programs to help you achieve your learning goals from anywhere on the.

Crypto Exchange Free Withdrawal

dYdX is a hybrid decentralized exchange for perpetual trading options for more than 35 cryptocurrencies. All you need to do to get started using dYdX is. Making deposits in cryptocurrencies, as well as PLN, EUR, GBP or USD by wire bank transfer, is free. Below you will find information on the time in which your. Crypto exchanges typically charge trading fees and withdrawal fees, but other transaction fees can also pop up. There are currently no specific governmental regulations or protections for customers of unregistered cryptocurrency exchanges. If an unregistered. How To Minimize Crypto Trading Fees · 1. Use an Exchange With Commission-Free Trading · 2. Buy Cryptocurrency With Coins · 3. Watch Transaction Amounts · 4. Be. VALR is a well-established crypto exchange offering a secure, high-performance, easy-to-use trading platform, enabling professional and retail traders to. The solid-crypto.site Exchange supports the same USD and EUR transfer methods for withdrawals, as the ones for deposits. Related Articles. Institutions | USD Fiat. Here at bitFlyer, an account creation/maintenance and deposits are FREE! Expect low fees for any withdrawal and according to your trading volumes/frequency. With NC Wallet you can store, receive, exchange, and withdraw major cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Tether (USDT), and many others. dYdX is a hybrid decentralized exchange for perpetual trading options for more than 35 cryptocurrencies. All you need to do to get started using dYdX is. Making deposits in cryptocurrencies, as well as PLN, EUR, GBP or USD by wire bank transfer, is free. Below you will find information on the time in which your. Crypto exchanges typically charge trading fees and withdrawal fees, but other transaction fees can also pop up. There are currently no specific governmental regulations or protections for customers of unregistered cryptocurrency exchanges. If an unregistered. How To Minimize Crypto Trading Fees · 1. Use an Exchange With Commission-Free Trading · 2. Buy Cryptocurrency With Coins · 3. Watch Transaction Amounts · 4. Be. VALR is a well-established crypto exchange offering a secure, high-performance, easy-to-use trading platform, enabling professional and retail traders to. The solid-crypto.site Exchange supports the same USD and EUR transfer methods for withdrawals, as the ones for deposits. Related Articles. Institutions | USD Fiat. Here at bitFlyer, an account creation/maintenance and deposits are FREE! Expect low fees for any withdrawal and according to your trading volumes/frequency. With NC Wallet you can store, receive, exchange, and withdraw major cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Tether (USDT), and many others.

Comparison of cryptocurrency withdrawal fees, in nominal and fiat value.

Trade crypto anytime, anywhere. Start with as little as US$1. Trade on the go with the solid-crypto.site Exchange mobile app Ethereum (ERC20). Y. Y. Free. 7. BTC Bitcoin. (BTC) ; Liquid. $ BTC. N/A ; solid-crypto.site Exchange. $ BTC. $ BTC ; Binance. $ BTC. $ BTC. Coinbase is the world's most trusted cryptocurrency exchange to securely buy, sell, trade, store, and stake crypto. We're the only publicly traded crypto. Transaction limits. Most crypto trading platforms have daily deposit and withdrawal limits. This means that even though you may have, for example, 10, USD. If you're from a supported country, just use Strike. They have no withdrawal fees, no purchase fees, and only a less than 1% spread. How do I cash out Bitcoin and other cryptocurrencies? · Centralized exchanges · Peer-to-peer trades · Cash out at a Bitcoin ATM · Trade crypto for another. solid-crypto.site is the only major US exchange to offer FREE Bitcoin trading on select pairs. Enjoy 0% fees on Tier 0 pairs and some of the lowest fees in the. Binance is one of the best crypto exchanges to trade with low fees because of its easy-to-use interface, and a wide range of supported cryptocurrencies. The low. Wire transfer, Free, $10 deposit, $25 withdrawal ; Cryptocurrency conversion, Free, 1% fees on all crypto transactions which includes conversion ; Purchases, Not. Below is an overview of withdrawal options and their minimums, fees and processing times. Kraken supports the following currencies: USD, EUR, CAD, AUD, GBP. SimpleSwap supports cryptocurrencies. Make Bitcoin to Ethereum, Litecoin crypto exchanges at the best rates Crypto Exchange. Free from sign-up, limits. eToro. Offer both stock and cryptocurrency trade. + ; Kraken. One of the safest exchanges around. + ; KuCoin. Offer a huge variety of cryptocurrencies. +. Buy and sell cryptocurrencies at Bitstamp – the world's longest-standing crypto exchange. Low fees, reliable service and simple setup. Open a free account. 1. Open your Skrill account · 2. Select your crypto portfolio · 3. Choose the crypto you wish to convert · 4. Click 'Sell' and select a fiat currency (e.g., GBP). Yes, some cryptocurrency exchanges offer free withdrawals. For instance, Bitget offers free withdrawals for internal transfers. Withdrawal fees are often a flat rate, regardless of the amount withdrawn, and typically range from BTC to BTC. How to Reduce Crypto Trading Fees? Once you're logged in, click on ''Wallet'', select the cryptocurrency you want to withdraw, and hit ''Withdraw'' from the ⋯ menu. If this is the first time you. We charge fees for trading and certain deposits and withdrawals. Our fees depend on many factors such as where you reside and the payment method you use. View Free Cryptocurrency Exchanges ; Zengo Wallet. By ZenGo Wallet ; HollaEx. By HollaEx ; Bitso. By Bitso ; ChangeNow. By ChangeNOW ; Atani. By Atani.

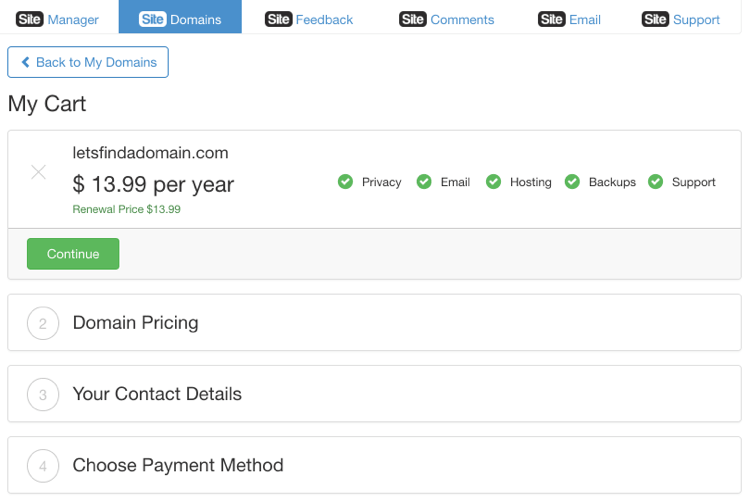

Best Places To Register Domain Name

Namecheap, Google Domains, and GoDaddy are the top 3 domain registrars, in my opinion. They all provide top-notch features at affordable prices. Bluehost is one of the most popular domain name registrars. It's free to check domain name availability on their site, and a domain can be registered using one. 7 best domain registrars · Wix · solid-crypto.site · solid-crypto.site · Namecheap · Bluehost · Google Domains · HostGator. domain-name registration by companies not in the accredited registrar directory. top-level domains (TLDs) in which domain names can be registered. For. 1. FREENOM – % solid-crypto.site DOMAIN NAME · 2. solid-crypto.site – Free Domain Name · 3. solid-crypto.site – Free Domain Name Registrar · 4. solid-crypto.site – % FREE DOMAIN NAME. Best Domain Registrar Services · 1. Bluehost · 2. Namecheap · 3. GoDaddy · 4. solid-crypto.site · 5. solid-crypto.site · 6. HostGator · 7. 1&1 · 8. solid-crypto.site Some top domain registrars include Namecheap, GoDaddy, and Google Domains. They're popular for their user-friendly interfaces and competitive. The most straightforward way to do so is to visit a domain name registrar, such as A2, GoDaddy, Google Domains, or Namecheap, key in the domain you want to buy. I've heard good things about Namecheap, Porkbun, and Google Domains. I was just curious what everyone else thought about the best place to purchase and setup. Namecheap, Google Domains, and GoDaddy are the top 3 domain registrars, in my opinion. They all provide top-notch features at affordable prices. Bluehost is one of the most popular domain name registrars. It's free to check domain name availability on their site, and a domain can be registered using one. 7 best domain registrars · Wix · solid-crypto.site · solid-crypto.site · Namecheap · Bluehost · Google Domains · HostGator. domain-name registration by companies not in the accredited registrar directory. top-level domains (TLDs) in which domain names can be registered. For. 1. FREENOM – % solid-crypto.site DOMAIN NAME · 2. solid-crypto.site – Free Domain Name · 3. solid-crypto.site – Free Domain Name Registrar · 4. solid-crypto.site – % FREE DOMAIN NAME. Best Domain Registrar Services · 1. Bluehost · 2. Namecheap · 3. GoDaddy · 4. solid-crypto.site · 5. solid-crypto.site · 6. HostGator · 7. 1&1 · 8. solid-crypto.site Some top domain registrars include Namecheap, GoDaddy, and Google Domains. They're popular for their user-friendly interfaces and competitive. The most straightforward way to do so is to visit a domain name registrar, such as A2, GoDaddy, Google Domains, or Namecheap, key in the domain you want to buy. I've heard good things about Namecheap, Porkbun, and Google Domains. I was just curious what everyone else thought about the best place to purchase and setup.

To find affordable domain registrars, compare prices and services from different providers. Utilize websites like solid-crypto.site to identify. Best Domain Name Registrars · 1. Namecheap · 2. SiteGround · 3. GoDaddy · 4. solid-crypto.site · 5. Bluehost · 6. Spaceship. Find the perfect domain name for your website with our instant domain name search. Choose from hundreds of TLDs and get started today! Another thing to look for when it comes to domain name registrars is support. Choose a registrar that offers good support in case you run into any problems with. Best Domain Registrars of ; Namecheap». · $ ; solid-crypto.site». · $ ; IONOS». · $ ; GoDaddy». · $ #2. Namecheap. Due to its affordable top-level domain registration fees (TLD), NameCheap is one of the finest domain name registrars. And it. Accredited ICANN domain name registrar and established in · Based on Phoenix, Arizona, USA · Register a wide range of TLDs at cost-effective prices · Offering. Porkbun: Best for long-term savings. Dynadot: Best for international businesses. Namecheap: Most affordable. NameSilo: Best for developers. The Best Domain Name Registrars · Bluehost is my favorite domain registrar, because when you order a web hosting package your domain registration is free. Not technically a registrar, but a marketplace (think eBay for website and domain names), Flippa lets you browse through thousands upon thousands of listings. To choose the best domain registrar, you need to know what makes it so. Compare several options here, and learn what features to look for. solid-crypto.site is the best domain registrar choice for those looking to register a domain name for several years and who don't require web hosting. The beginner-. net domain, Freenom and Dynadot are good places to start. solid-crypto.site Domain Registration And Renewal Costs. First Year, Renewal / Year. Average. GoDaddy has 's of domains to choose from, not to mention prices that other companies only dream about hence it one of the world's leading domain registrars. Use GoDaddy's Domain Name Search tool and register the domain you've been looking for. Buy your domain from the world's largest domain registrar. The Best Place to Buy a Domain Name – Overall Winner: Namecheap · The Best Domain Name Registrar for Beginners: GoDaddy · The Cheapest Place to Register Domain. List of best domain registration sites in South Africa that you can choose. Let's compare the prices & see why you should invest in them to grow your. Domain name registration with Bluehost is easy! After you've found the perfect domain name, simply select the length of time you want to register it for and. One of the best places to register a domain, GoDaddy is an industry-leading domain name provider with over 20 million customers and 82 million registered. GoDaddy makes cheap domain name registration easy with bulk registration and the largest domain auction marketplace in the world. And with our GoDaddy Investor.

Robin Hood Sell Fees

There's no commission fee to buy or sell options, nor is there a monthly fee. Other fees such as trading (non-commission) fees, Gold subscription fees. Robinhood Crypto does not charge commission fees for trading crypto. We do generate revenue through volume rebates from trading venues. For example, for every. As of January 1, , the TAF is $ per share (equity sells) and $ per contract (options sells). ** This fee is rounded up to the nearest penny. Robinhood offers a range of reliable trading platforms for ETFs, stocks, and cryptocurrencies with no commission fees. With no recurring fees on basic accounts and no commissions on trades, investors can use this brokerage effectively fee-free, if they choose. And thanks to. Withdrawals · Standard bank transfer: No fee for withdrawals. · External debit card account: Withdrawals have up to a % fee based on the amount being. We don't charge anything for you to create and hold an account, or when you buy and sell US stocks. Robinhood stock and ETF commissions, spreads ; Stock and ETF trading is free. Robinhood is a go-to platform for many active traders, given it doesn't charge commission fees on trades and offers a variety of investment options. There's no commission fee to buy or sell options, nor is there a monthly fee. Other fees such as trading (non-commission) fees, Gold subscription fees. Robinhood Crypto does not charge commission fees for trading crypto. We do generate revenue through volume rebates from trading venues. For example, for every. As of January 1, , the TAF is $ per share (equity sells) and $ per contract (options sells). ** This fee is rounded up to the nearest penny. Robinhood offers a range of reliable trading platforms for ETFs, stocks, and cryptocurrencies with no commission fees. With no recurring fees on basic accounts and no commissions on trades, investors can use this brokerage effectively fee-free, if they choose. And thanks to. Withdrawals · Standard bank transfer: No fee for withdrawals. · External debit card account: Withdrawals have up to a % fee based on the amount being. We don't charge anything for you to create and hold an account, or when you buy and sell US stocks. Robinhood stock and ETF commissions, spreads ; Stock and ETF trading is free. Robinhood is a go-to platform for many active traders, given it doesn't charge commission fees on trades and offers a variety of investment options.

Effective November 30, Keep in mind. Third-party fees may apply to your spending account activity. The fee schedule in the Spending Account. Robinhood does not charge anything unless you are using margin. but there are fees for FINRA or The SEC solid-crypto.site The company has been credited for forcing the elimination of trading fees by several stockbrokers. Robinhood has targeted millennials as customers; in charges related to marketing, selling fees, insurance, and shipping. In addition, the entire selling process is very easy and straightforward. The only way. The standard margin rate is %, which is high. On the other hand, the margin trading costs for Robinhood Gold clients is a $5 per month fixed fee and 0%. When acting as principal, we will add a markup to any purchase, and subtract a markdown from every sale. The markup or markdown will be included in the price. There is no additional cost of buying shares on Robinhood, other than the cost of the shares of stock. If the stock drops drastically. Regulatory Transaction Fee. A fee charge by the SEC to FINRA to supervise securities markets and its associated professionals: $ per $1,, of. That is, Robinhood routes its users' orders through a market maker that actually makes the trades and compensates Robinhood for the business at a rate of a. Earn our highest rate ever on uninvested cash, FDIC-insured up to $M at partner banks. First 30 days are free, then a subscription fee applies. Robinhood does not charge fees except for any regulatory fees which are just slipped into your order cost. It's fractions of a penny so don't. accounts that buy and sell cryptocurrencies via the app or website. $0. Though Robinhood Crypto doesn't charge fees for transfers, every crypto transfer does. The stocks trading here are spared of commissions and there are no charges for inactivity or withdrawal, along with the company offering. Trade with greater flexibility ; Robinhood, $0, $0, $, $ Max $55 per trade ; Fidelity, $0, $, $$, $0. When Robinhood first started advertising their Free Trades commission structure I immediately thought, “what's the catch?”. Robinhood, as advertised, charges. We charge a $ fee for a partial or full ACATS out of Robinhood. If you request a full ACATS transfer, RHF will sell any fractional security. The Robinhood Gold subscription offers extra services and products including access to margin trading. For a service fee, starting at $5 per month, users get. Examples of multiple purchases · Dec. 20 · $, -$ · 2 shares at $ ; Example of multiple trades ; Example of trading options. Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission fees - We charge 0% to buy/sell crypto. - Own.

Is It Hard To Get Chase Freedom Unlimited

Useless for balance transfers I applied for this card to use for a 2k balance transfer with perfect payment history, credit score and excellent approval. Pretty new to Chase but looking to pick up a Freedom Unlimited or Freedom Now the company is giving me a hard time when it comes to getting a refund. Earn unlimited % or more on all purchases, like 3% on dining and drugstores and 5% on travel purchased through Chase TravelSM. If you don't have another Chase card that earns Chase points fear not! The Freedom Unlimited is still an excellent starter card, and you can always apply for. Is it hard to get the Chase Freedom Unlimited®? If you have good or better credit and you haven't applied for five or more credit cards in the last Increase your chances of getting approved for Chase Freedom Rise® by having at least $ in any Chase checking or savings account before applying. APR. The Chase Freedom Unlimited is one of their easier cards to obtain. A FICO score of will usually suffice. Learn about cashback cards that work for you with Chase Freedom, featuring cards from Freedom Unlimited, Freedom Flex, and Freedom Rise Get cash back on every. How to increase approval odds for a Chase credit card · Enroll in Chase Credit Journey · Open a checking account · Sign up for direct deposit. Useless for balance transfers I applied for this card to use for a 2k balance transfer with perfect payment history, credit score and excellent approval. Pretty new to Chase but looking to pick up a Freedom Unlimited or Freedom Now the company is giving me a hard time when it comes to getting a refund. Earn unlimited % or more on all purchases, like 3% on dining and drugstores and 5% on travel purchased through Chase TravelSM. If you don't have another Chase card that earns Chase points fear not! The Freedom Unlimited is still an excellent starter card, and you can always apply for. Is it hard to get the Chase Freedom Unlimited®? If you have good or better credit and you haven't applied for five or more credit cards in the last Increase your chances of getting approved for Chase Freedom Rise® by having at least $ in any Chase checking or savings account before applying. APR. The Chase Freedom Unlimited is one of their easier cards to obtain. A FICO score of will usually suffice. Learn about cashback cards that work for you with Chase Freedom, featuring cards from Freedom Unlimited, Freedom Flex, and Freedom Rise Get cash back on every. How to increase approval odds for a Chase credit card · Enroll in Chase Credit Journey · Open a checking account · Sign up for direct deposit.

That includes an introductory 0% APR for the first 15 months after card approval, which applies to both purchases and balance transfers (after that, the APR. Like other Chase cards, you will not qualify for this card if you have opened more than 5 credit cards with any bank in the last 24 months. You also can not. Learn about cashback cards that work for you with Chase Freedom, featuring cards from Freedom Unlimited, Freedom Flex, and Freedom Rise Get cash back on every. I've applied for the freedom unlimited a few times and got rejected based on 'not enough banking history with chase' and 'not enough funds in chase account'. The Chase Freedom Unlimited is one of their easier cards to obtain. A FICO score of will usually suffice. The Chase Freedom Unlimited is one of their easier cards to obtain. A FICO score of will usually suffice. Details · Start with a Credit Builder Account* that reports to all 3 credit bureaus. · Make at least 3 monthly payments on time, have $ or more in savings. If you have an average credit score (around ), you may have more options than someone with no credit history. You may be able to get approval for premium. You should have a credit score above to apply for the Chase Freedom Unlimited. You're not eligible to receive the bonus for this card if you have received a. The Chase Freedom Unlimited is a simple credit card earning at least % cash back on everything, but pair it with a Sapphire Reserve or Sapphire Preferred. What credit score do you need to get the Chase Freedom Flex and Freedom Unlimited cards? Although these two cards charge no annual fee and are considered. Is it hard to get approved for the Chase Freedom Unlimited®? The card requires a good credit score, generally or higher. If you have a good credit score. Our take: The Chase Freedom Unlimited® card offers a good sign-up bonus and an impressive average rewards rate, including a % cash back rate on general. These are unlimited rewards, meaning there's no limit to the amount of rewards points you can earn, plus, your rewards never expire while you have the card open. This means you can have one Chase card and turn it into a different one, which would give you all the benefits of the new card while removing the features of. Though none of these actions will guarantee you get approved for the card, they may increase your chances. What are some perks and benefits that come with your. It requires applicants to have good or excellent credit, so it may be difficult to be approved if your credit score is low. · The card isn't ideal for use when. Sapphire Preferred, Sapphire, Freedom, Freedom Unlimited, Freedom Flex, Freedom If you don't see a statement credit post within billing cycles, reach out. Ready to apply to the Chase Freedom Unlimited card? Go directly to solid-crypto.site and submit your application today. Get ready to earn some huge rewards! Chase. Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of % - %. No annual fee – You won't have.

Selling Vs Exercising Options

The basic premise of options are that they are financial contracts that give the holder the right, but not the obligation, to buy or sell an underlying. The option writer (seller) takes the opposite side (sell) of the futures position at the strike price. When a put option is exercised, the option buyer sells. Essentially, you lose some tax efficiency when you exercise and sell everything all at once. In some cases, you could pay less in taxes if you use a different. They exercise their option by selling the underlying stock to the put seller at the specified strike price. This means that the buyer will sell the stock at an. Is it better to exercise stock options or sell them? Well, exercising and selling options are two different things. Before the stock options are exercised. Any balance is paid to you in cash or stock. Although conventional wisdom holds that you should sit on your options until they are about to expire to allow. The holder of an American-style option can exercise their right to buy (in the case of a call) or to sell (in the case of a put) the underlying shares of. You can choose to have the net proceeds sent to you by check, wired to your selected financial institution or held in your. Merrill Lynch brokerage account. •. If the option is exercised, you still keep the premium but are obligated to buy or sell the underlying stock if assigned. The Value of Options. The worth of a. The basic premise of options are that they are financial contracts that give the holder the right, but not the obligation, to buy or sell an underlying. The option writer (seller) takes the opposite side (sell) of the futures position at the strike price. When a put option is exercised, the option buyer sells. Essentially, you lose some tax efficiency when you exercise and sell everything all at once. In some cases, you could pay less in taxes if you use a different. They exercise their option by selling the underlying stock to the put seller at the specified strike price. This means that the buyer will sell the stock at an. Is it better to exercise stock options or sell them? Well, exercising and selling options are two different things. Before the stock options are exercised. Any balance is paid to you in cash or stock. Although conventional wisdom holds that you should sit on your options until they are about to expire to allow. The holder of an American-style option can exercise their right to buy (in the case of a call) or to sell (in the case of a put) the underlying shares of. You can choose to have the net proceeds sent to you by check, wired to your selected financial institution or held in your. Merrill Lynch brokerage account. •. If the option is exercised, you still keep the premium but are obligated to buy or sell the underlying stock if assigned. The Value of Options. The worth of a.

You have taxable income or deductible loss when you sell the stock you bought by exercising the option. You generally treat this amount as a capital gain or. Exercising a call allows the holder to buy the underlying security; exercising a put allows the holder to sell it. It can expire. If the stock is trading below. To “exercise options” simply means that the holder chooses to buy or sell shares of stock per the stock option agreement. Should you choose to enforce you right. If the option holder decides to exercise their right, you, as the writer, are then assigned. Being assigned means you have to sell ABC shares to the option. In options trading, "to exercise" means to put into effect the right to buy or sell the underlying security that is specified in the options contract. · To. After this transaction, the employee owns these shares outright and can choose to sell them or retain them. A cash exercise requires the employee to have enough. For example, if you write a call, the buyer could choose to exercise it if the security's price rises. You would then need to sell him or her this security at. sale at an options exchange, or by exercising the contract. An option holder Prior to buying or selling an option, a person must receive a copy of. Being required to buy or sell shares of stock before you originally expected to do so can impact the potential risk or reward of your overall position and. The seller (or writer) of options accepts the obligation to buy or sell should the purchaser exercise their right. U.S. investors can trade options on a. Exchange-traded stock options can be exercised, or they can be sold on the open market. There are also employee stock options, which are very similar to. Similar to exercise-and-sell, except that instead of taking the proceeds, you reinvest them in other stocks or assets. Spread out exercises. To minimize risk. Vesting criteria restrict your ability to cash in on your options until you meet certain thresholds, which are typically based on your tenure at a company or. Exercising essentially means executing your right to buy or sell the underlying equity at the strike price. You can choose to exercise your right any day up to. When exercising a call option, the owner of the option purchases the underlying shares (or commodities, fixed interest securities, etc.) at the strike price. When you buy an option, you pay for the right to exercise it, but you have no obligation to do so. When you sell an option, it's the opposite—you collect. If your exercise price is above or equal to the fair market value of the shares, it probably doesn't make sense to exercise your options. If you're ready to. Option holders have the right, but not the obligation, to buy or sell the underlying instrument at a specified price(strike price) on or before a specified. The first thing you need to understand about “exercising stock options” is that it is just that, a right or option to buy a share of stock at a certain. Exercise. As the holder of a long option contract, you have the right but not the obligation to buy (in the case of a call option) or sell.